Investing in the stock market has long been considered a prudent way to build wealth and achieve financial goals. Among the numerous options available, investing in individual stocks of reputable companies can offer substantial returns over time. Atlassian Corporation Plc, a renowned technology company, has gained significant attention from investors due to its innovative products and consistent growth. In this comprehensive guide, we will walk you through the steps of investing in Atlassian stock, equipping you with the knowledge needed to make informed investment decisions.

- Understanding Atlassian Corporation Plc

Before diving into the investment process, it is essential to understand the company you are investing in. Atlassian is a leading Australian-based software company founded in 2002 by Mike Cannon-Brookes and Scott Farquhar. The company is known for its suite of collaborative and productivity software products that cater to developers, project managers, and teams across various industries.

Atlassian’s flagship products include Jira, Confluence, Trello, Bitbucket, and more, which are widely used by businesses worldwide to streamline project management, communication, and development processes. The company’s commitment to innovation, strong customer base, and consistent revenue growth have contributed to its popularity among investors.

- Conducting Research

Investing in individual stocks requires thorough research to make informed decisions. Here are some key aspects to consider while researching Atlassian:

2.1. Financial Performance: Review the company’s financial statements, including revenue, earnings, and profitability over the past few years. Analyze trends in growth and profitability to understand the company’s financial health.

2.2. Competitive Landscape: Assess Atlassian’s position in the market and its competitors. Understanding the company’s competitive advantages can help gauge its potential for sustained growth.

2.3. Market Trends: Examine the industry and market trends relevant to Atlassian’s products and services. A company aligned with growing market trends may have higher potential for long-term success.

2.4. Management Team: Learn about Atlassian’s leadership and management team. The competence and vision of the leadership can significantly impact the company’s performance.

2.5. Risk Factors: Identify potential risks and challenges that may impact Atlassian’s future performance. These could include industry-specific risks, regulatory changes, or technological disruptions.

- Choosing a Stock Brokerage Account

To invest in Atlassian stock, you will need a brokerage account. A brokerage account serves as a platform to buy, sell, and hold stocks. Here are some factors to consider when selecting a brokerage account:

3.1. Fees and Commissions: Compare the fees and commissions charged by different brokerage platforms. Look for one that offers competitive rates and aligns with your investment style.

3.2. User Interface and Tools: Evaluate the user interface and available tools on the brokerage platform. A user-friendly interface and research tools can enhance your investing experience.

3.3. Account Types: Ensure the brokerage offers the account type you require. Common options include individual brokerage accounts, joint accounts, retirement accounts (e.g., IRA or 401(k)), and custodial accounts for minors.

3.4. Customer Support: Good customer support is essential for addressing any issues or queries you may encounter during your investment journey.

3.5. Security: Choose a brokerage that prioritizes the security of your personal and financial information.

- Funding Your Brokerage Account

Once you have chosen a brokerage account, you will need to fund it before you can start investing. Most brokerage platforms offer various funding methods, such as bank transfers, wire transfers, and electronic funds transfers (EFTs). Depending on the platform, you may be able to set up automatic transfers to contribute regularly to your investment account.

- Types of Stock Orders

Before buying Atlassian stock, familiarize yourself with different types of stock orders:

5.1. Market Order: A market order is executed immediately at the current market price. It is suitable for investors who prioritize quick execution over the specific price.

5.2. Limit Order: A limit order allows you to set a specific price at which you are willing to buy Atlassian stock. The order will only be executed if the stock reaches or falls below your specified price.

5.3. Stop Order: A stop order becomes a market order once the stock reaches a specified price (stop price). It is useful for limiting losses or protecting profits.

5.4. Stop-Limit Order: This type of order combines features of stop and limit orders. When the stock reaches the stop price, the order becomes a limit order with a specified price.

- Assessing Atlassian’s Stock Performance

As an investor, analyzing Atlassian’s stock performance is essential in making informed decisions:

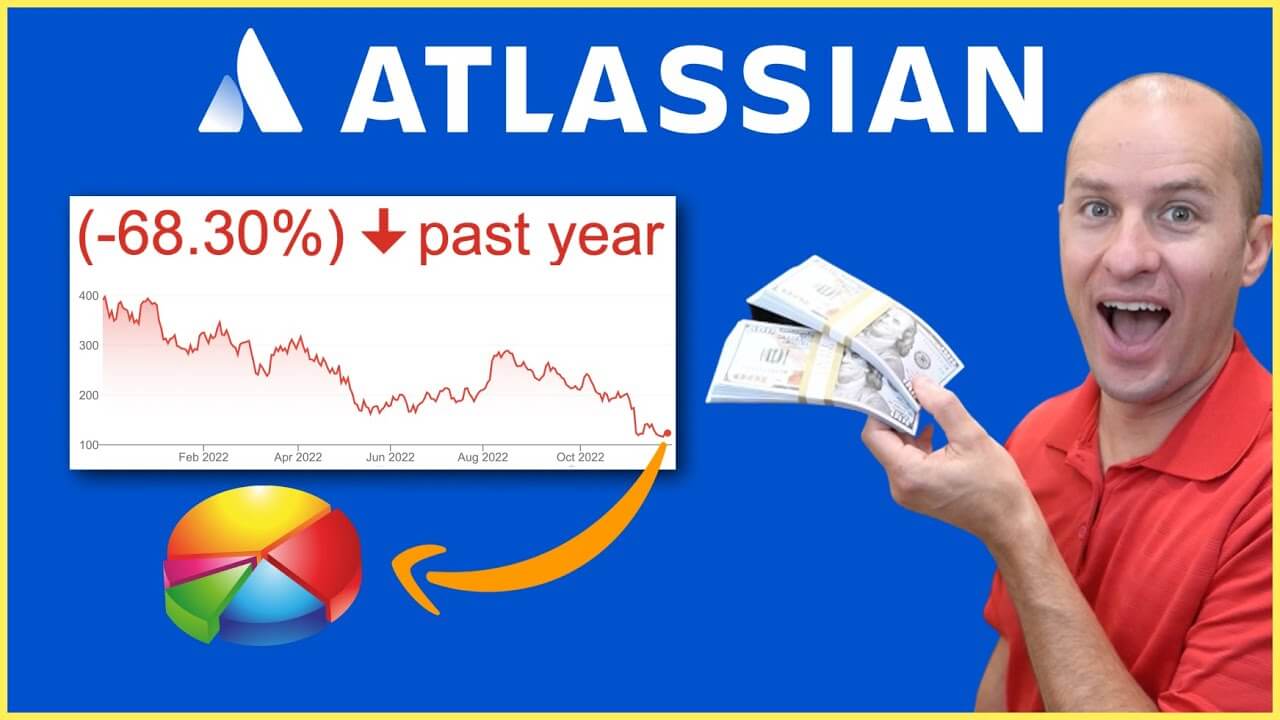

6.1. Historical Stock Price: Examine the historical stock price chart to identify trends and patterns. This analysis can help you understand the stock’s price volatility.

6.2. Stock Volatility: Assess the stock’s volatility by calculating metrics such as beta and standard deviation. Higher volatility indicates greater price fluctuations.

6.3. Dividend Policy: Atlassian does not currently offer dividends, so investors seeking dividend income may consider other options.

6.4. Analyst Recommendations: Consider analyst recommendations and price targets for Atlassian stock. Analyst reports can provide valuable insights into the company’s future potential.

- Diversification

Diversification is a fundamental principle of investing that helps manage risk. Instead of putting all your funds into a single stock like Atlassian, consider building a diversified investment portfolio comprising different asset classes and industries. Diversification can help reduce the impact of a decline in one investment on your overall portfolio.

- Long-Term vs. Short-Term Investing

Decide on your investment horizon – whether you aim for long-term growth or short-term gains. Long-term investors focus on holding stocks for years, benefiting from potential growth and compounding. Short-term investors, on the other hand, may aim to capitalize on short-lived market trends or price fluctuations.

- Monitor Your Investment

After investing in Atlassian stock, it’s important to monitor your investment regularly. Stay informed about the company’s performance, industry developments, and general market trends. Adjust your investment strategy if circumstances change, and be prepared to hold through periods of market volatility.

Conclusion

Investing in Atlassian stock can be a rewarding endeavor for investors who believe in the company’s growth potential and are willing to conduct thorough research. Understanding the company, choosing the right brokerage account, and adopting a disciplined investment approach are key elements for success. As with any investment, it is crucial to assess your risk tolerance, investment horizon, and financial goals before committing funds. By approaching your investment journey with diligence and patience, you can potentially reap the benefits of owning a stake in a prominent and innovative technology company like Atlassian. Remember, investing in the stock market carries inherent risks, and seeking advice from a financial advisor is always advisable for personalized guidance.