Routing numbers play a crucial role in the world of banking, enabling seamless transactions, direct deposits, and electronic fund transfers. If you’re a Wells Fargo customer, knowing your routing number is essential for various financial activities. In this comprehensive guide, we’ll walk you through the process of quickly finding your Wells Fargo routing number, understand its significance, and provide insights into related banking terms.

Understanding Routing Numbers:

A nine-digit identifier known as a routing number is used to identify the financial institution in charge of handling transactions. It is frequently known as the “ABA routing number” or just the routing transit number. Routing numbers are vital for various financial transactions, including direct deposits, wire transfers, electronic bill payments, and automatic debits.

Why You Need Your Wells Fargo Routing Number:

Knowing your Wells Fargo routing number is essential for several reasons:

- Direct Deposits: Routing numbers are used by several employers, governmental organizations, and financial institutions to facilitate correct direct deposits into your Wells Fargo account.

- Bill Payments: To make sure your payments are made to the right account when you set up electronic bill payments, you’ll need the routing number.

- Wire Transfers: For both domestic and international wire transfers, routing numbers are essential to direct funds accurately.

- ACH Transactions: Automated Clearing House (ACH) transactions, such as recurring payments and transfers, require the correct routing number.

Finding Your Wells Fargo Routing Number:

To quickly find your Wells Fargo routing number, you have a few options:

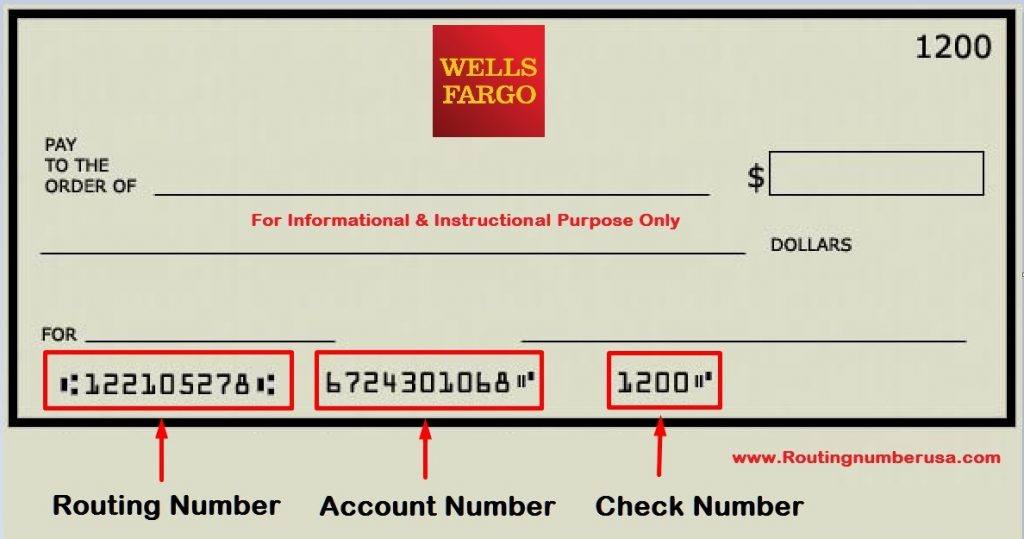

1. Check or Statement:

You may frequently find your routing number on your check or bank statement. You can notice a series of digits in the bottom left corner of your check. Your routing number begins with the first nine digits.

2. Online Banking:

Log in to your Wells Fargo online banking account. Once logged in, you can find your routing number in the account details or settings section. The routing number may also be available in your account summary.

3. Wells Fargo Website:

Go to the “Routing Numbers” section of the Wells Fargo website (www.wellsfargo.com). A list of route numbers for many states and areas can be found on this page.

4. Mobile App:

If you use the Wells Fargo mobile app, you can find your routing number by navigating to the account details or settings section within the app.

5. Customer Service:

You can get in touch with Wells Fargo customer support if none of the options above help you locate your routing number. The right routing number for your account can be provided with the help of a specialist.

Key Considerations:

While finding your Wells Fargo routing number is straightforward, there are a few important considerations to keep in mind:

- Accuracy: Ensure that you provide the correct routing number for any transactions or direct deposits. Using an incorrect routing number can result in delays or errors in processing.

- Different Routing Numbers: Wells Fargo has different routing numbers for different states and regions. Make sure you use the routing number associated with your specific account.

- Security: Be cautious when sharing your routing number online or over the phone. Only provide this information to trusted and authorized entities.

Additional Banking Terminology:

As you explore routing numbers, you might encounter related banking terms that are worth understanding:

- Account Number: Your account number is a unique identifier for your specific bank account. It works in conjunction with the routing number to ensure accurate transactions.

- Wire Transfer: A wire transfer is a method of electronically sending funds from one financial institution to another. It’s commonly used for large transactions and international transfers.

- ACH: The Automated Clearing House (ACH) network makes it possible to conduct electronic transactions including fund transfers, bill payments, and direct deposits.

- Direct Deposit: Electronically transferring money into a bank account without a middleman is known as direct deposit. Paychecks, tax refunds, and government benefits are frequently paid using it.

Conclusion:

Understanding your Wells Fargo routing number is essential for seamless financial transactions. Whether you’re receiving direct deposits, making bill payments, or initiating wire transfers, having the correct routing number ensures that your transactions are processed accurately and efficiently.