Stock investing can be a successful strategy to gradually increase your money, but there are dangers and unknowns involved. There has been a lot of recent media coverage of Lucid Group Inc. (LCID), particularly in light of the company’s objectives for the electric vehicle (EV) market. In this article, we will look at both the advantages and disadvantages of adding LCID stock to your financial portfolio to help you make that decision.

Pros of Investing in LCID Stock:

1. Electric Vehicle Market Potential:

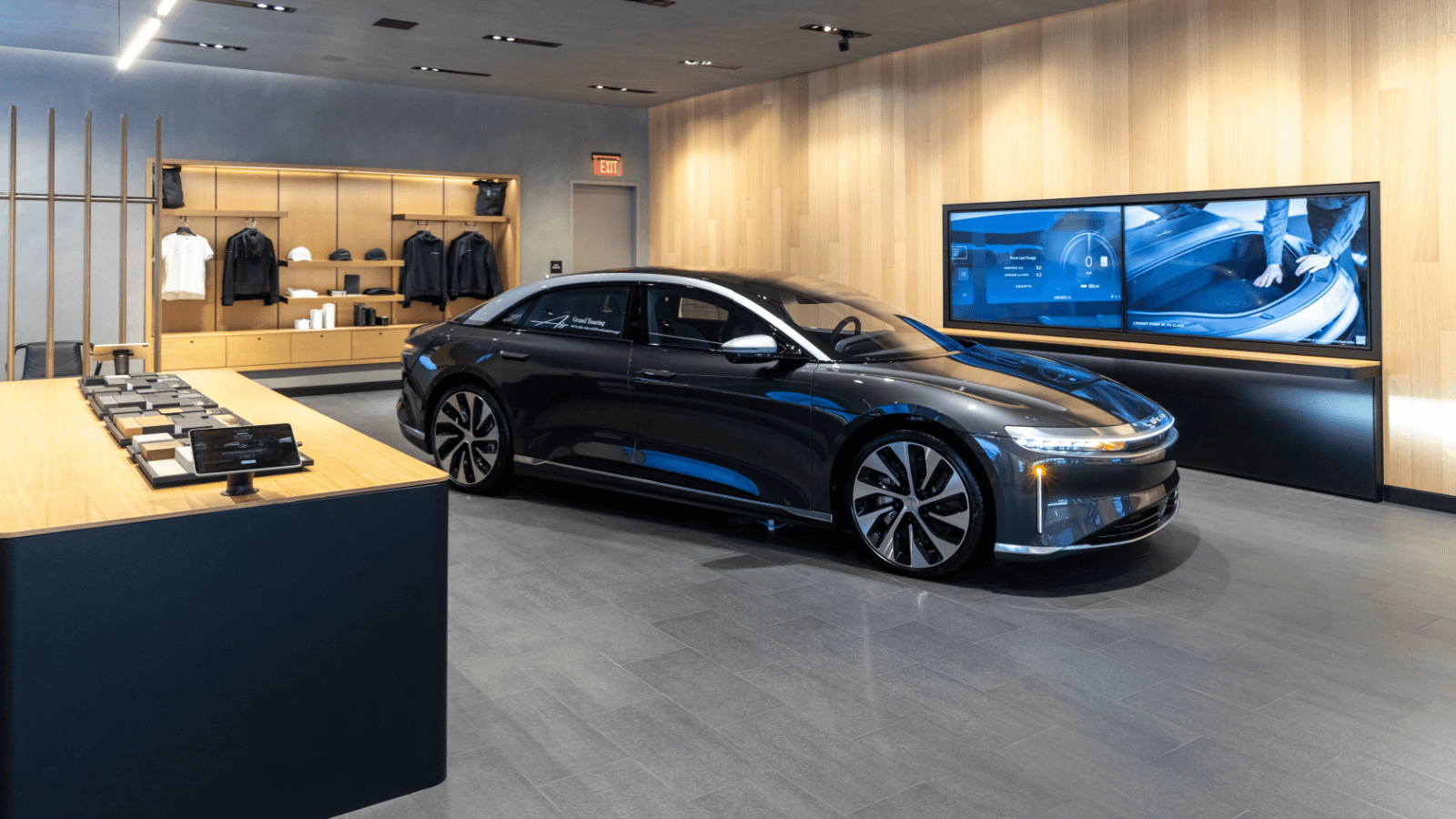

The fact that LCID is active in the electric car sector is one of the main factors attracting investors to the company. As the world progresses toward sustainable energy and transportation options, electric vehicles have grown to be a significant contributor to reducing carbon emissions. The company’s flagship vehicle, the Lucid Air, has won praise for its cutting-edge design, extensive range, and performance capabilities.

2. Innovation and Technology:

For prospective investors, LCID’s emphasis on innovation and cutting-edge technology is a definite advantage. With attributes like its cutting-edge battery technology, autonomous driving capabilities, and opulent style, the company hopes to stand out from rivals. The company’s dedication to pushing the limits of EV technology is demonstrated by the Lucid Air’s outstanding range and fast-charging capabilities, which might help it stand out in a crowded market.

3. Experienced Leadership:

LCID benefits from having experienced leadership at the helm. Peter Rawlinson, formerly the Tesla Model S’s Chief Engineer, is now the company’s CEO. Due to his considerable expertise in EV technology and the business, investors have confidence in the company’s ability to overcome challenges and seize opportunities.

4. Strong Reservations and Pre-Orders:

Investor sentiment often sways with consumer interest, and LCID has garnered strong reservations and pre-orders for its Lucid Air model. High demand for a company’s product can indicate a favorable market outlook and potentially translate into robust sales and revenue growth.

5. Long-Term Growth Potential:

Investing in a company like LCID requires a long-term perspective. If the company can execute its business strategy successfully, there is potential for significant growth over the years as the adoption of electric vehicles increases and the company expands its product lineup.

Cons of Investing in LCID Stock:

1. Competitive Landscape:

While the electric vehicle market offers substantial growth potential, it is also fiercely competitive. Established players like Tesla, as well as traditional automakers entering the EV space, present challenges for newer entrants like LCID. Gaining market share and establishing a solid customer base can be difficult in such a dynamic environment.

2. Production Challenges:

The automotive industry is notorious for production challenges, and LCID is not immune to them. Scaling up production to meet demand can be a complex and resource-intensive process. Delays or issues in production can lead to missed revenue targets and disappoint investors.

3. Capital Intensive Nature:

Developing electric vehicle technology and manufacturing capabilities requires significant capital investments. While the potential returns can be substantial, the initial outlay of funds can strain a company’s financial resources, potentially leading to a need for additional funding through equity issuance or debt.

4. Uncertain Regulatory Environment:

Government regulations and policies play a significant role in the electric vehicle market. Changes in regulations regarding emissions standards, incentives, or subsidies can impact the market dynamics and the demand for EVs. Investors in the sector should be prepared for potential shifts in the regulatory landscape.

5. Market Sentiment Volatility:

The stock market can be influenced by sentiment and speculation. Positive news about a company can drive stock prices up, while negative news can lead to rapid declines. This volatility can be more pronounced in industries like electric vehicles, where growth projections are high, but execution is crucial.

Conclusion:

Investing in LCID stock comes with both promising opportunities and potential risks. The electric vehicle market’s growth potential, LCID’s innovation, and experienced leadership are compelling reasons to consider investing. However, the competitive landscape, production challenges, and regulatory uncertainties are important factors that investors must also weigh.

Thorough research and a clear grasp of your risk tolerance are crucial for any investment. If you have faith in LCID’s long-term plans and its capability to overcome obstacles in the market for electric vehicles, including it in a diverse investment portfolio may be in line with your financial objectives. Before making any investment decisions, always seek the advice of a financial professional and perform your due diligence.